Earlier this year, retired NYSE trader William Higgins tried to buy a seat in his wife's name when the seats were fetching about $1 million. But as he and his wife Beth were waiting for her fingerprints to be cleared by authorities, seat prices moved up to about $1.4 million. Mr. Higgins decided that was too steep.

Toronto money manager Thomas Caldwell is one of the largest owners of New York Stock Exchange seats, having bought 22 in the last two years. He would buy more, if not for centuryold rules aimed at maintaining the cachet of one of capitalism's most exclusive clubs.

Yet even as Mr. Caldwell and others clamor to buy seats -- memberships conveying the right to trade on one of the nation's oldest financial exchanges -- the club, in a sense, is about to close: The exchange's decision to become a public company through a purchase of electronic trading firm Archipelago Holdings Inc. will put an end to centuries of tradition. After the combined NYSE Group Inc. starts trading, the market for the exchange's 1,366 seats will disappear, and those looking to speculate on the value of the Big Board's business will have to use the exchange's common stock.

Meantime, Mr. Caldwell and other speculators still aim to join the ranks of John D. Rockefeller, J.P. Morgan Jr. and other notable seat owners who have come before them. Many of those now actively pursuing seats, including money managers from around the world, are hoping to receive a payout of cash and stock currently valued at about $3.5 million that each seat holder is promised under terms of the NYSE/Archipelago deal.

They won't have an easy time of it. The process of buying a seat hasn't changed much during the last 100 years, and it requires a lot of patience. Each new membership must be submitted under a new individual's name and be sponsored by two other people, usually exchange members. As many as six months can pass as the exchange checks backgrounds and personal information, including fingerprints, and reviews references. After all that, applicants pony up the going price for a seat. Their names are then published in a bulletin for all members to review before the seat sale is formally approved.

"It's a total nuisance," says Mr. Caldwell, who is still waiting for the exchange to sign off on one of his most recent membership purchases.

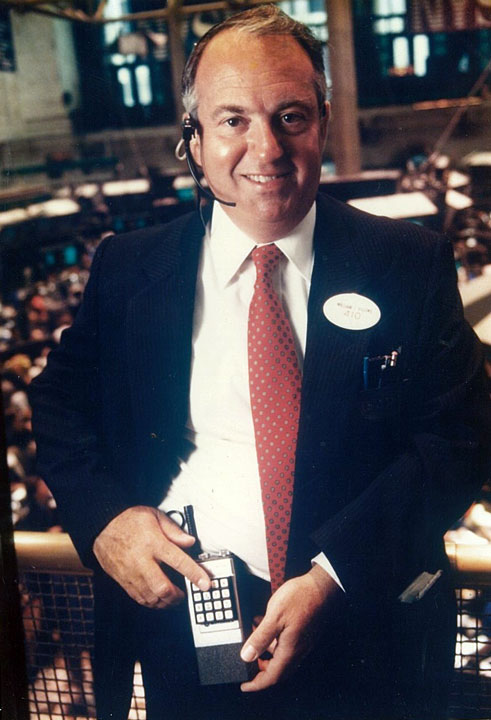

Mr. Caldwell, who first visited the NYSE while working for Merrill Lynch & Co. in the 1970s, hopes to buy a few more seats before the Big Board goes public, probably sometime in the next nine months. His strategy to date has been buying on behalf of trusted associates, because exchange rules stipulate that no one person can own more than one seat.

But the 61-year-old is running out of friends and family: He already has bought seats in the names of his wife, two assistants and a 24-year-old research analyst. "She is going around and saying she's the youngest member of the NYSE," Mr. Caldwell says of the analyst. "She'll probably be one of the last, too."

Others who also believe Big Board seats will pay off as investments haven't gotten as far, including Gordon Faux, a 26-year-old business-school student who once worked for Mr. Caldwell as an analyst. Mr. Faux applied to buy a seat in April after the Archipelago deal was announced, dutifully sending the 25 or so pages of paperwork required of new buyers. After two months, he was still waiting to hear if he could buy a seat.

Earlier this year, retired NYSE trader William Higgins tried to buy a seat in his wife's name when the seats were fetching about $1 million. But as he and his wife Beth were waiting for her fingerprints to be cleared by authorities, seat prices moved up to about $1.4 million. Mr. Higgins decided that was too steep.

Seat prices on an upswing have been a source of income for some. In the late 1970s, retired traders started leasing their seats out. Then outside investors, including the late race-car driver Dale Earnhardt and private-equity investor Steven Rattner, began buying seats to lease.

After peaking at $2.65 million in 1999 during a bull market for stocks, the price of a seat plunged to less than $1 million early this year amid fears that the exchange would lose ground to electronic competitors like Archipelago. News of a deal with that firm raised seat prices again, and nearly three dozen seats have traded since the deal was announced on April 20, a frantic day when interested parties initially were unable to a get a quote on seats.

But the heated market for seats also has become a testy one. Allison Wey, the wife of floor trader Richard Wey, sued the exchange this month, contending Chief Executive John A. Thain had promised Mr. Wey in February that the exchange had no plans to go public. That statement led the Weys to sell their seat in March for $1.54 million, leaving nearly $1 million on the table when the announcement of the Archipelago deal sent seat prices soaring, the suit alleged. The NYSE says the case is without merit.

All of this is a long way from where the exchange began in 1792, when a group of men bartered under a buttonwood tree on Wall Street. They moved indoors a few years later, and traders were assigned chairs from which they stood to buy or sell when an auctioneer called off a stock they wanted. The chairs were removed in 1871 after the NYSE merged with a rival, but the name "seat" stuck.

Clubby rules were in place from early on. For many years, members voted on applicants, at one point by placing black or white marbles in a box. An admissions committee of senior members took over but was later replaced by NYSE staff. The U.S. Supreme Court opened the process somewhat in 1963, ruling that the NYSE couldn't deny access to market participants without fair procedures like a hearing. But the Big Board's first female member, Muriel "Mickey" Siebert, recalls asking about a dozen members to sponsor her in 1967 before finding two willing to back her.

Meanwhile, Mr. Caldwell and his cohorts -- clients, partnerships and a mutual fund, as well as a son, who together own more seats than most Wall Street banks -- are still in the market. "The best value on the NYSE is the NYSE," says Brendan Caldwell, the son of the money manager.

Original: For an NYSE seat, stand in line